You’re one click away from better coverage. Start your quote with Holley Insurance today!

-

Our Phone: (540) 334-4225

-

Our Email: service@holleyinsurance.com

Insurance FAQ’s: What is an Experience Modification Factor?

You may have heard of a mod in regards to your workers compensation insurance. But what is it really and how does it affect you?

Let’s start with the definition of a “mod”

Mod is an abbreviation for Experience Modification Factor. Some people refer to it as experience mod, or mod for short. You can think of a mod as your company’s safety score. How likely are your employees to be injured on the job? What type of safety measures do you have in place to ensure a safe working environment?

Fewer workplace injuries = Lower mods

More workplace injuries = Higher mods

How is a mod calculated?

An experience mod is calculated by dividing actual losses by expected losses.

Actual Losses/Expected Losses

Actual Losses: Workers’ comp claims that a company has incurred during a 3-year valuation period. This includes the number of claims and the cost of each of these claims. It makes sense that the more claims you have, the more expensive your workers comp policy is going to be.

Expected Losses: This comes from the company’s payroll and their class codes. An underwriter looks at the class code nationally and comes up with a factor that represents the cost of claims associated with that code. The lower the rate, the less risky the insurance industry believes the class code to be. If you are a company with a high payroll, you have more employees, and thus, more risk.

Other factors that contribute to your mod:

- Whether the claims are still open or if they are closed and paid in full. If the claim is closed, this will have a positive impact on your mod.

- The premium that was paid over the 3 year period

The baseline (or your starting point) is a 1.0. Once your mod is calculated it will usually range from .70 to 1.4.

If your company has a Mod under 1, then you are considered a “safe” company. If your Mod is over 1, it is believed that your business is more risky and you will be charged a higher premium.

In review: The higher your Mod is, the higher your premium. The lower your Mod is, the lower your premium.

It is important to know, the state in which you operate is responsible for handling the credits or debits on your mod. Not your agent or insurance carrier.

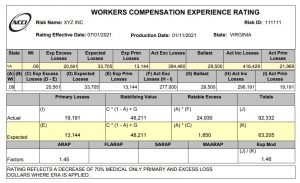

Let’s take a look at an example:

If XYZ Inc. has a mod of 1.46, this means that they have a “credit” of .46 and their insurance premium will be 46% higher than what it would have been if they were at the baseline of 1.0.

However, if you had safety measures in place and it was determined that your mod is a .80, your premium would DECREASE by 20%

See how important it is to run a safe business?

Now that you know what a mod is and how it’s calculated, you may be wondering how to reduce your Mod factor? Check out this blog post to find out!

Here at Holley Insurance, we have a program that can actually evaluate your company’s experience modification factor.

We are able to evaluate how your Mod could change based on the types of claims you have and how it would affect your premium. Want to find out the lowest possible Mod your business could have? We can tell you!

If you’re interested in having our expert create a mod evaluation for FREE, fill out this form.

If you’re a small business owner, we’d love to talk to you about the specific risks your businses faces and how we can help you protect it. Every one of our protection advisors is an expert in business insurance. Contact us here and let’s get started!

A little more about Holley Insurance…

Holley Insurance was founded in 2000, and retains a core base of loyal clients. We have locations in Roanoke, Rocky Mount, and Forest, VA. As an independent insurance agency, Holley Insurance represents a carefully selected group of financially strong, reputable insurance companies. Therefore, we are able to offer you the best coverage at the most competitive price. Holley Insurance was named “Top Insurance Broker in Southwest Virginia” by Virginia Living Magazine for 2021.